The ITR Economics Trends Report™ offers economic forecasts, insights, and strategies to help businesses gain a competitive edge. Subscribers value the report for its accurate three-year market forecasts, unbiased perspectives, and actionable Management Objectives™, all accessible online and via the ITR onDemand App. Begin your Trends Report journey today to plan with confidence and identify growth opportunities for your business!

US Construction Economy At-a-Glance

January 2025

Construction markets are showing both correction and opportunity.

🏠 Single-unit housing starts face a longer and deeper contraction as affordability pressures, inventory mismatches, and weak builder sentiment continue to weigh on activity.

🏢 Multi-unit housing is stabilizing near current levels, but a looser apartment market points to softer activity through 2026 before improvement begins.

🏭 Manufacturing construction is pulling back as the market corrects following years of elevated, government-supported investment, and weakness is expected into late 2027.

🏢 Office construction shows limited upside as return-to-work policies support some demand, though growth remains muted.

🏬 Warehouse construction is positioned for multi-year recovery, with demand improving through 2028, though performance will vary by region.

🏥 Healthcare and education construction remain relatively stable, supported by long-term demand, with selective growth opportunities ahead.

For construction leaders, this uneven landscape reinforces the importance of sector-specific planning, disciplined capital allocation, and a forward-looking strategy as markets adjust.

Residential Construction a Soft Spot in a Growing Economy

February 2025

“2026 is going to be a year of growth for a large portion of the US economy. Consumers are on stable financial footing overall and have increased the volume of their goods and services purchases by 2.5% over the last year. This spending accounts for slightly over two thirds of Real GDP and flows through to businesses that will, in turn, invest in equipment and intellectual property. The government spending portion of GDP is growing at a slowing pace. Most businesses operating in industrial, capital goods, and consumer markets will see their top line grow this year, although special attention should be paid to avoiding profitless prosperity, as there is some risk of margin compression. Leading indicators tell us that the year ahead will be one of growth, but it will be at a relatively mild to moderate pace.

The construction segments of GDP are the outliers. Nonresidential structures lag the macroeconomy; the current decline reflects the prior jump in interest rates and prior sluggish economic growth. Investments in residential structures and equipment are down 2.3% from one year ago.

We recently downgraded our outlook for residential construction, but we want to put this change in perspective first. Residential construction makes up only 3.2% of Real GDP. While this will cause pain for some businesses, this small segment is not going to derail growth for the macroeconomy in 2026."

ITR Trends 10

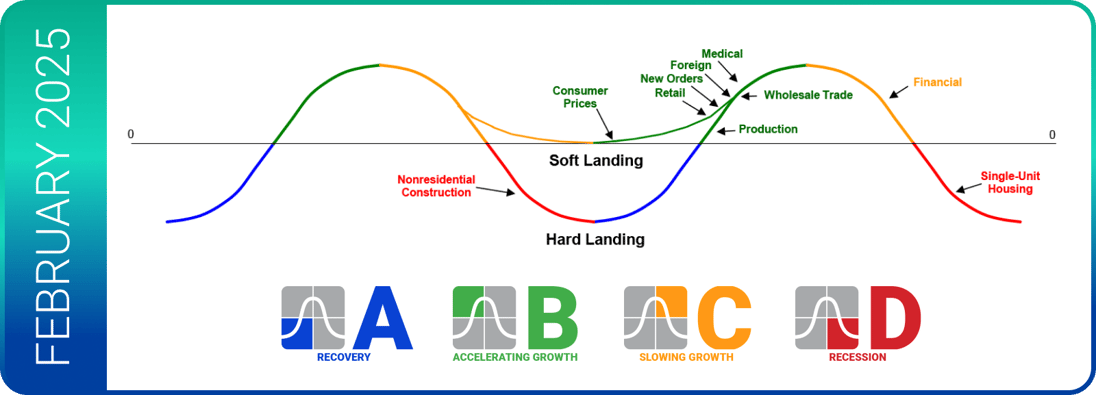

The Trends 10 summary provides a dynamic look at the economy. Each major segment of the economy is shown in terms of where it is in the business cycle. Each phase of the business cycle (A, B, C, D) carries its own Management Objectives™ which enable firms to enhance profitability while preparing for the next phase of the business cycle.

Equipped with accurate insights from the Trends Report, your business will have the foresight to make data-driven decisions and craft strategic plans that promote business growth. By anticipating market trends and efficiently allocating resources, you can mitigate risks and secure a competitive edge!

77 Sundial Ave. Suite 510W

Manchester, NH 03103

603-796-2500

© 2024 ITR Economics