94.7% FORECAST ACCURACY || BUSINESS-MINDED ECONOMISTS || UNBIASED AND APOLITICAL

This article is provided by ITR Economics in partnership with Sheet Metal & Roofing.

ITR Economics’ outlook for a mild macroeconomic recession in 2024 is predicated in large part on anticipated Federal Reserve action. We expect the federal funds rate to rise by roughly 50−100 additional basis points (0.5 to 1 percentage points) in the first half of 2023 before the Federal Reserve reverses course and pursues more dovish monetary policy, leading to a return to positive territory for the 10-year to 3-month Treasury yield spread by the end of this year. Our analysis suggests that the lead time between the “un-inversion” of the yield curve and the bottom of the business cycle is roughly 12 months. If the yield curve inversion were to extend beyond this year, the US economy would be contending with stronger-than-anticipated headwinds, which would likely lead to a deeper and/or longer-lasting recession.

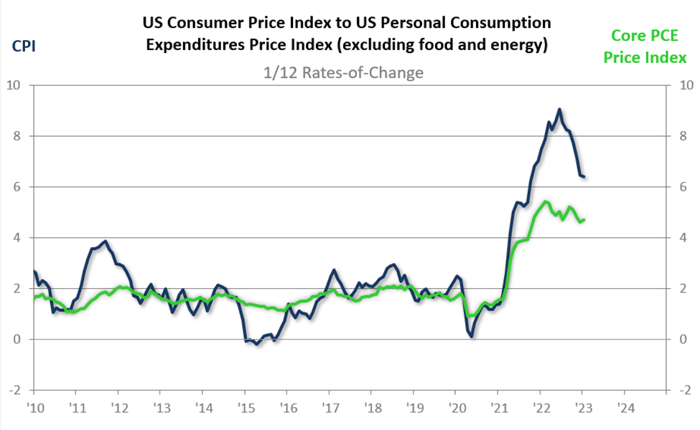

While the exact course of the Federal Reserve is unknown, recent comments by chairman Jerome Powell suggest the Fed is considering increasing the pace of rate hikes, following its 25-basis-point (0.25 percentage points) hike in early February. Powell’s comments largely stem from continued strength in the labor market, despite news of layoffs (especially in the tech sector). In addition, the Fed’s preferred inflation metric, the Personal Consumption Expenditures (PCE) Price Index (excluding food and energy), has remained higher for longer than the body had anticipated; the 1/12 is down 0.7 percentage points, from 5.4% in March 2022 to 4.7% as of January 2023. By contrast, the US Consumer Price Index (CPI), ITR’s preferred metric, has shown more defined downward movement – the 1/12 is down 2.6 percentage points, from 9.1% in June 2022 to 6.4% as of this January. The chart below compares the 1/12 rates-of-change of the CPI and the core PCE Price Index.

It is yet to be seen if the Fed’s recent hawkish comments will carry over to policy. New data could change the Fed’s tune in the coming months.

So − what does a hawkish Fed in the face of recession mean for your business? In any recession, but especially one with risks to the downside, it is important to build and maintain a cash buffer for your business. High interest rates will pose less of a threat to your operations if you are able to fund projects with cash. Furthermore, cash will give you the means to find alternative avenues if a supplier or customer drags their feet on payment or delivery.

On the flip side, avoid making unnecessary long-term financed investments at the current high interest rates. Some investments are likely to remain profitable, such as those oriented toward automation or other labor-saving efficiencies, given a still-tight labor market. Keep in mind that there are opportunities to be had in all phases of the business cycle, and having extra cash on hand will help you take advantage of them.

77 Sundial Ave. Suite 510W

Manchester, NH 03103

603-796-2500

© 2024 ITR Economics